CARES Act: Say YES to critical facility upgrades

Did you know the Cares Act signed in 2020 allows you to write off 100% of qualifying facility improvement costs?

It might seem surprising to invest in non-residential building upgrades in the midst of a global pandemic, but it is a great time thanks to the added tax benefits.

Here’s why – When you invest in upgrades — e.g., install a new HVAC system — you get a tax deduction for the project costs. In the past, this deduction was taken over a 39-year period, resulting in a 2.5 percent write-off each year.

That’s now changed – The 2020 Coronavirus Aid, Relief, and Economic Stability (CARES) Act allows a full deduction of certain project costs in a single year, without limitation on the project’s size. If you’ve been waiting for the right time to make major facility upgrades, now is the time!

What facilities qualify?

Qualified improvement properties (QIPs), including:

• Hospitals and healthcare facilities

• Office buildings

• Factories and plants

• Logistics facilities

• Any other non-residential property

What facility upgrades can benefit from the accelerated deduction?

Non-structural upgrades (including both equipment and installation costs) to the interior envelope of existing facilities, including:

• Building management systems

• Sensors, valves, actuators, and other HVAC devices

• Uninterruptible power supplies, switchgear, and other electrical distribution equipment

What isn’t included in QIPs?

• New construction

• Upgrades to the facility’s structure (e.g., expansions, remodeling, etc.)

• External envelope of the building (e.g., windows, doors, roof, cladding)

• Residential structures

• Certain equipment (e.g., elevators)

What else do you need to know about the Section 168 deduction?

• There’s no limit on the cost of equipment that can be expensed.

• You can combine it with other incentives, such as renewable energy tax credits and utility rebates, for extra savings.

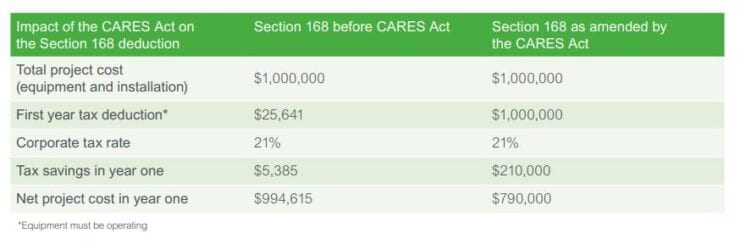

Example cash savings of a QIP project cost

A fictional hospital invests $1,000,000 in a digital building management system upgrade, including new smart devices

(e.g., sensors, room controllers, valves, actuators). The chart shows the tax benefits before and after the changes the

CARES Act made to Section 168 of the tax code. The benefit of the accelerated depreciation results in a cash savings of

$204,615 in year one.

To discuss how the CARES Act can help you upgrade your HVAC building systems, Contact Air Control Products today.